In Contrast to a Tariff a Quota Does Not

The quota is a limit defined by the government on the quantity of goods produced in the foreign country and sold domestically. Economy by simply setting an import quota equal to that number of vehicles.

A key difference between tariffs and quotas is that O consumers are hurt with quotas but not with tariffs.

. A tariff is more protective in the face of import volume decreases. Non-Equivalence of Tariffs and Quotas. On the other hand a quota is a quantity limit.

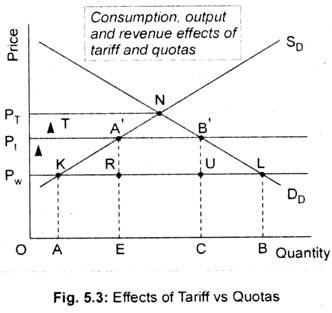

A tariff is a tax imposed on an imported good. 53 amount is imposed then price would rise to P t because the total supply domestic output plus imports equals total demand at that price. While the quota is a government-defined restriction on the number of commodities produced in a foreign nation and sold in the local market.

If a quota is administered by selling quota tickets ie import rights then a quota will generate government. Quotas may or may not generate revenue depending on how the quota is administered. O the government receives revenue with tariffs but the importer receives added profit with quotas.

In contrast to quotas is enforced on the numerical worth of commodities rather than the volume and. It is normally imposed by the government on the imports of a particular commodity. The effects of tariffs are more transparent than quotas and hence are a preferred form of protection in the GATTWTO agreement.

In case of tariffs on the other hand no such rigidity les a tariff is rather mild and flexible in its restrictive influence. As opposed to quota is imposed on the numerical value of goods not the amount and so it has no effect. Under this system import of a commodity up to a specified quantity is allowed to be imported duty-free or at a special low rate of duty.

The Tariff vs. A tariff has an immediate advantage for governments in that it will automatically generate tariff revenue assuming the tariff is not prohibitive. A tax imposed by governments on imports.

The ability of an individual a firm or a country to produce a good or service. A tax imposed on imports whereas a quota is an absolute limit to the number of units of a good that can be imported. In some cases the taxes are so exorbitant that no buyer wishes to import them overseas and the buyer must seek local vendors to supply the item instead.

Goods and services bought domestically but produced in other countries. Goods and services produced domestically but sold in other countries. 2Tariffs earn revenue for the government and increase the GDP of the country while quotas are for the number of the products traded and not the amount paid.

But imports in excess of this fixed limit are charged a higher rate of duty. Quota Bottom Line. The tariff quota thus combines the features of.

What is the difference between Tariff and Quota. While both tariff and quota are restrictive trade policies meant to protect domestic producers they differ in their ways. Importers still make profit despite paying high out-of-quota tariff.

1Tariffs are the taxes imposed by the government of a country on import and export products while a quota is the limitation imposed by the government on the number of goods that can be either exported or imported. Legislators knew in advance how many Japanese vehicles Americans would import after they imposed a 10 tariff then the legislators could in principle achieve roughly the same outcome on the US. O the government receives revenue with quotas but the importer receives added profit with.

A tax levied on exports whereas a quota is a limit on the number of units of a good that can be exported. In contrast if a standard quota is in place it is not possible to expand import volume over. It restricts imports of commodities physically.

As a result of this. Because of this quotas are less frequently used than tariffs. The Tariff Quota The tariff or customs quota is a widely acclaimed measure.

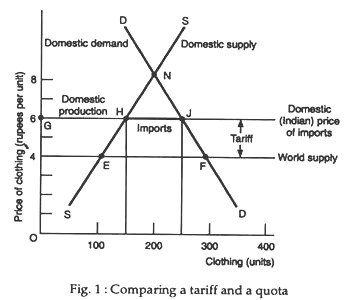

A tariff differs from a quota in that a tariff is. One of the key differences between a tariff and a quota is that the welfare loss associated with a quota may be greater because there is no tax revenue earned by a government. If an import quota of EC Fig.

Generate revenues for government. Tariff is a tax while quota puts a restriction on the quantity of import. A tariff differs from a quota in that a tariff is a a.

Gwartney author of Economics. Thus they are harsh are inflexible in their operation. In fact they can be represented by the same diagram.

For these reasons tariffs are generally considered to be preferable to import quotas. A tariff is a levy that is levied on imported products. Tariffs are taxes and generate revenue for a government while quotas are restriction on physical quantity of a product.

Tariff quota or embargo The United States does not allow any goods from Cuba to be sold in the United States. Suppose the tariff you set in the previous exercise was 50 percent then imports cell E36 should be 10. The results are quite different.

The out of quota commitment does not set any limit on the quantity or value of a imported product but instead applies a different normally higher tariff rate to that product. To see whether this holds with monopoly increase the quota in cell O31 to 10. Tariff quota or embargo A 10 tax.

There is no limit on the quantity of goods which can be imported from foreign countries in case if there is tariff on that good but in case of quota in no circumstance one can import more than stipulated quaintly of good in case if there is quota on. Thus quota is a quantitative limit through imports. See the answer See the answer done loading.

It specifies the maximum amount that can be. Usually quotas fix a rigid quantitative limit on imports. Tariffs provide income for the nation hence increasing GDP.

O consumers are hurt with tariffs but not with quotas. Under perfect competition a quota of 10 should be equivalent to a tariff of 50 percent. Tariff results in generating revenue for the country and hence increase the GDP.

The main difference is that quotas restrict quantity while tariff works through prices. A quota is more protective of the domestic import-competing industry in the face of import volume increases. The primary effects of an import quota are the same as those of a tariff.

Question 17 2 points In contrast to a tariff a quota does not. Tariff results in more income to the government while quota does not result in extra income for the government. Public and Private Choice states that the average tariff on goods imported to the United States.

Tariff quota or embargo Only 100000 barrels of oil can be delivered to Italy this month. A tariff is a tax on imports. This isnt the view of most Americans or apparently of a majority of members of Congress but it is one held by some free.

However some economists believe that the best solution to the problem of tariffs and quotas is to get rid of them both.

Are Tariffs And Quotas Equivalent In Their Economic Effects

No comments for "In Contrast to a Tariff a Quota Does Not"

Post a Comment